The TPA, Defense Counsel and You Part II

This is being written in follow up to my last post where the Third Party Administrator attempted to advise the Self- Insured Employer and his attorney that the only person with decision making authority was the Claims Adjuster. It again becomes clear in this post that the TPA is not interested in doing what is best for the Self-Insured Employer or the claim.

TIME FOR YOU TO REVIEW YOUR SERVICE INSTRUCTIONS!

Self-Insured Employers each have service instructions about vendors to be used. It is a Self-Insured Employers right to designate what vendors are to be used. The TPA must abide by those service instructions. If you are seeing counsel, or IME physicians or surveillance companies being used in your claims that you are not familiar with the best place to start to look is what instructions you have given the TPA in working on your claims. If you do not assign appropriate vendors as this TPA said here, your vendors will be picked for you.

The Self-Insured Employer who was involved in this TPA driven claim, requested that the service instructions be changed to reflect that litigated claims were to be sent directly to counsel and that the counsel would be handling the disputed claims and that counsel would select the IME physicians and the Surveillance company. The TPA refused to put this counsel’s name in the service instructions and would only list “Ohio counsel.” The service instructions were amended to include that “Ohio counsel” would have the right to pick the surveillance company and the IME physician. Yet again, a TPA interfering in a business relationship between the Self-Insured Employer and counsel. Let me reiterate the Self-Insured Employer has the right to alter those service instructions to reflect the wishes of the company.

The Self-Insured Employer advised that on this particular claim they would not be using the TPA vendors. The TPA’s response was that they would not pay those vendors through the claim. The Self-Insured Employer stated that all bills for the IME and the surveillance company be sent to them directly. Tracking costs of the claim, seems a task appropriate for a TPA but this one will only do it if the Self-Insured Employer uses their vendors. TPA’s are more interested in doing tasks that are beyond them, i.e. the practice of law and creating cost centers for their company rather than doing the tasks that they are specifically paid to perform.

When all was said and done, based upon the recommendations of counsel for an IME physician and excellent work done by the Investigative Company including WEBtap, video surveillance, the Self-Insured Employer secured a win across the board, winning at both DHO and SHO Hearings.

The message is clear here, if Self-Insured Employers want to be successful in litigated claims they need to become informed enough to make decisions for their company and have those trained to practice law take the lead.

Employer violated FMLA by not freezing its point reduction policy during approved FMLA leave:

Dyer v. Ventra Sandusky LLC, 934 F. 3d 472 (6th Cir.)

Employer had a no fault attendance policy in which points were assessed for absences. Once 11 or more points accumulated, the employer was terminated. The employer also had a policy where employees could reduce the number of points. For each 30 day period of perfect attendance, one point would be reduced. Vacations, bereavement, jury duty, military duty, union leave and holidays counted toward the 30 days, and the employee would not be penalized for taking those types of excused absences to accrue the 30 days resulting in a point reduction.

Employee Dyer had migraines and took approved intermittent FMLA leave. Each day he was off for approved FMLA, the 30 day period was reset to zero. He eventually accumulated 12 points under the no fault attendance policy and was terminated. He brought suit in Federal Court alleging violation of FMLA. The Sixth Circuit Court of Appeals held that the employer’s attendance point reduction schedule violated the FMLA because it interfered with Dyer’s right to take FMLA leave ad be restored to an equivalent position, even though the taking of the FMLA did not in itself count toward the 11 point limit. The taking of the FMLA should have “frozen” the accrual of perfect attendance during the leave, as the other types of specified leave, ie vacation, bereavement, jury duty, military duty, union leave and holidays.

TPA Liability

Self-insured employers rely on third party administrators to manage their workers’ compensation claims, however when TPA mistakes are made who is liable? Mistakes which are violations of the self-insured rules, i.e. untimely payment of compensation, result in a Self-Insured employer being penalized with a self-insured complaint. Multiple self-insured complaints put the very privilege of self-insurance at risk. While some mistakes result in self-insured complaints, there are some mistakes such as the unauthorized certification of a claim, the authorization of treatment for non-allowed conditions which directly result in the increase of a self-insured employer’s claim costs.

TPAs are professional organizations, and can be held to a standard of care. TPAs carry errors and omissions insurance coverage, in the same way as other professionals, such as insurance agents, architects, engineers, doctors, lawyers, and dentists. Although TPA standard of care is very fact dependent, it requires a TPA to exercise the skill and knowledge normally possessed by members of the profession in good standing in similar communities.

When a TPA actions fall below the standard of care, it may seem like the only result is that employer pays, with no accountability for a mistake by the TPA. However, a covered occurrence may have been triggered under the TPA errors and omissions policy. A professional malpractice claim is like any other negligence claim in that it requires proof of a breach of standard of care resulting in damages.

If you believe that you are paying for claim costs due to TPA negligence, please call us for a free consultation.

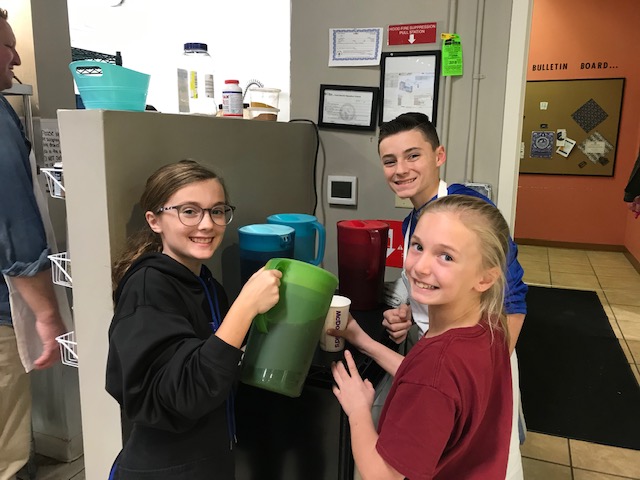

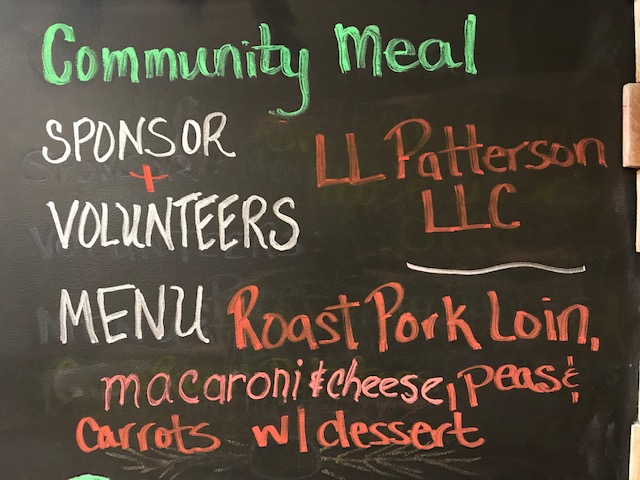

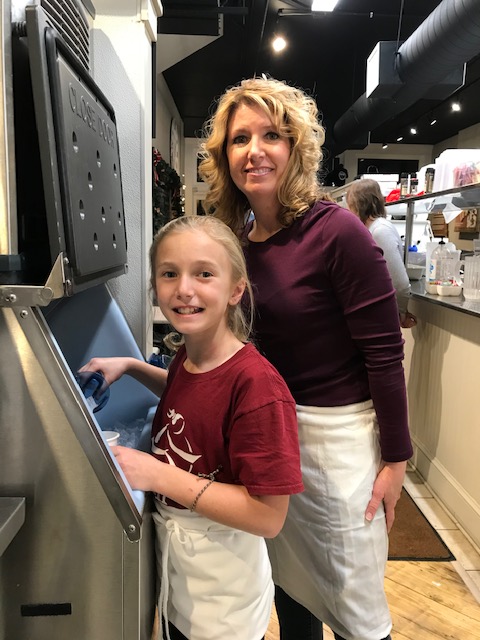

LL Patterson LLC sponsors and volunteers at Community Meal at One Bistro 12/11/19

Lisa Patterson and her staff spread some Christmas spirit by volunteering at the Community Meal at One Bistro in Xenia on December 11, 2019, serving over 85 meals.

Lisa Patterson sponsored the Community Meal, and supports One Bistro’s mission to “provide a place where our neighbors eat and come together as one community.”

Check out the photos of great volunteers working and making our community a better place!

ARE SUBROGATED EMPLOYERS LIMITED BY THE AMOUNT CLAIMANT RECOUPS IN A PERSONAL INJURY CASE? NO.

Self- insured employers have subrogation rights by statute, applicable when an employee is injured by a negligent third party, and the employer incurs claim costs. In most cases, a statutory formula is used to calculate the amount a subrogated employer may recover in an agreed settlement of the injured worker’s personal injury case, and the recoverable amount is a ratio of the entire settlement taking into consideration the injured worker’s attorney fees and expenses, regardless of how much the employer has actually paid or will pay in the future. The statutory formula provides an incentive for the parties to settle and divides the money in an equitable fashion.

Recently, however, LL Patterson encountered a case where this did NOT happen, and we were able to recover for the employer an amount that exceeded the statutory formula calculation. One of the reasons we were able to obtain such an unusual and favorable result is because the injured worker and the third party tortfeasor aligned themselves and attempted to settle the tort case without the consent of the subrogated employer. The Ohio statute that governs workers’ compensation subrogation, R.C. 4123.931, actually addresses this situation and gives subrogated employers the right to recover EVERYTHING paid in the claim PLUS the estimated future claim costs against BOTH the injured worker AND the negligent third party. This “joint and several liability” provision of 4123.931 is a very powerful tool in the employer’s favor. It is also a fact pattern that we do not see play out very often for the reason that, it is not in the best interests of the injured worker or the third party to attempt to settle without the consent of the subrogated employer, as it opens them up to more liability than they would otherwise have under 4123.931.