The TPA, Defense Counsel, and you (The Client)?

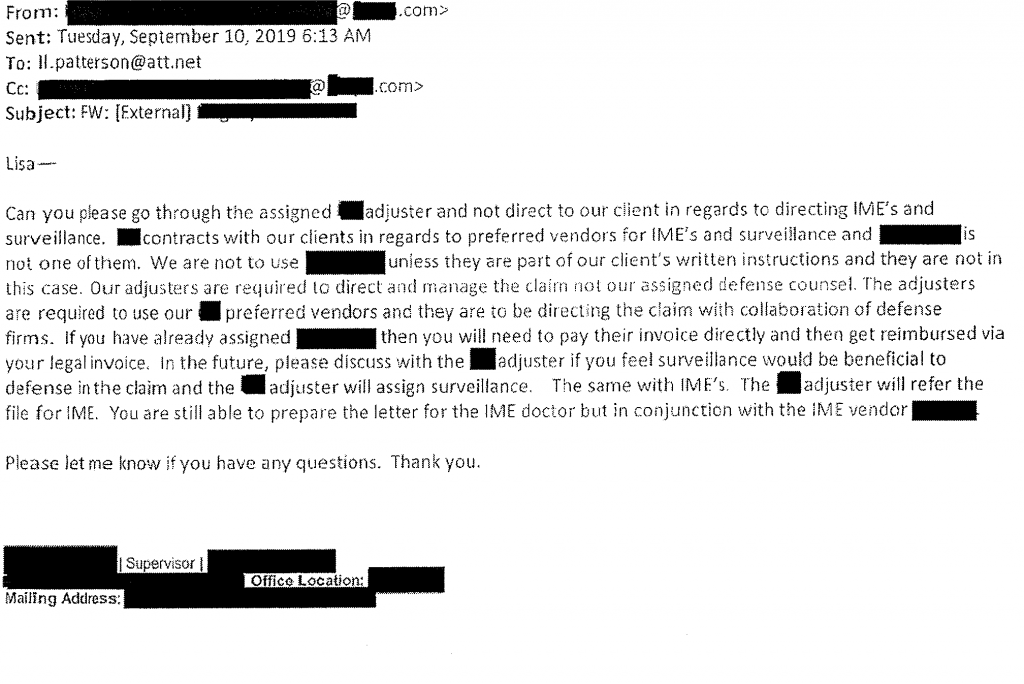

I recently received this email from a Third Party Administrator. It is clear that this Claims Supervisor believes that it is her right to interfere with the legal relationship between attorney and a self-insured employer, but it raises the question- what should be the central objective for each of the professionals on your team? And more importantly what is your goal when utilizing defense counsel. Do you hire defense counsel to take hearings? Do you hire defense counsel to develop both a factual and medical defense? Do you want decisions made on your behalf in litigation by non-attorneys?

The impetus of this email is a growing trend in which litigation is being controlled by non-attorneys to further the economic objectives of the huge conglomerate Third Party Administrators and more specifically, blatant engagement in the unauthorized practice of law. Litigated claims are being directed not by the client through advice of counsel, but by non-attorney claims adjusters.

With that being said, in the 25 years I have practiced in this area, I have encountered amazing, dedicated Third Party adjusters. These experienced and seasoned professionals work hand in hand with defense counsel to provide for their client the best defense in Ohio Workers’ compensation claims. This teamwork is the stuff of 20+ years of successful representation of employers in Ohio with the main objective to 1) have the claim denied; 2) have the claim closed; 2) have the claim settled. These should be the only objectives of a workers’ compensation program. Not every case requires litigation, but when it does a client is best served if the Attorney can provide legal advice to the client to achieve those objectives.

It bears repeating, the Client has the authority to accept recommendations made by an attorney for legal defense. Defense counsel’s duties require them to communicate with, advise, counsel and advocate for our clients, the self-insured employers.

What you don’t see in this email:

- A discussion of what would be best for the claim.

- A discussion of what would be best for the client.

- What expert physician/surveillance company would be best for this individual claim.

- An acknowledgement that this self- insured employer has had 3 different claims examiners in 3 months, and this claims examiner had no familiarity with this case.

What you see in this email:

- Defense counsel is being asked not to speak directly to the self-insured employer.

- Claims adjusters, to the exclusion of self-insured employers, will make all decisions in the claim file.

- All vendors should be in the umbrella of companies provided by the TPA.

- A conflict between a counsel’s legal duties to the self-insured Employer and the TPA’s dedication to furthering their own interests.

Third party administrators are great at managing claims. Lawyers are great at conducting litigation. Isn’t it time the client takes control? How do you want your claims handled?

Things Clients Want to Know:

Q.In a system where the Employer must always be reactionary

how can Employers move towards proactive and take control of the claim?

A. Prior to any decision about the compensability of a claim an

employer must investigate whether the Employee was injured in the

course of and arising out of his or her employment. It is becoming

more frequent that injured workers do not disclose all prior medical

treatment and yet it is this very documentation that is crucial to the

determination of whether a claim is compensable. As the number of

Industrial Commission hearings continues to plummet, hearings are

being set sooner, forcing employers to participate in hearings where

increasingly they don’t have all the facts. The single most effective

thing an employer can do to control the timing of the processing of the

claim is to immediately send out a medical release and begin to

request medical records. This places the ball so to speak in to the

Employee’s court.

Without a medical release AND a list of medical providers the Employer

has the right to stop processing of the claim and file a motion to suspend

until the requested documentation is received. While a suspension does

nothing more than delay benefits and processing it allows the employer

the adequate time to mount a successful defense. While most use the

BWC release, many providers have their own release and those will also

need to be secured from the Employee. The Hearing Administrator

presides over any failure to provide a medical release and failure to

respond to medical records request. By the Employer doing their due

diligence, they insure that claims are not processed prior securing all the

facts. Once again, preparation is always key to being successful at the

hearing table. If you have having difficulty securing either medical

releases or medical records please contact us.

An amendment to R.C. 4123.512 extends the court appeal deadline where the parties intend to settle a claim.

RC 4123.512 sets for the procedure to appeal a final order from the Industrial Commission into the court of common pleas. A notice of appeal must be filed within 60 days of receipt of the Industrial Commission Order.

This 60 day appeal deadline can now be extended by either the claimant or employer upon the filing of a notice of intent to settle the claim. The notice of intent to settle the claim must meet several requirements:

- It must be filed with the administrator of the BWC;

- It must be filed within 30 days of receipt of the final Industrial Commission Order; and

- It must be served on the opposing party and the party’s representative.

If these criteria are met, the deadline for filing an appeal into common pleas court is extended to 150 days UNLESS the opposing party files an objection within 14 days.

WARNING! The intent of this provision is to allow parties time to settle claims. BUT it also sets up a scenario where benefits will otherwise be extended for an additional 150 days in a claim being appealed by the employer.

UPDATE – SUCCESS FOR STATE FUND EMPLOYER! BWC APPROVES APPLICATION TO CHARGE SURPLUS FUND FOR NON AT FAULT MOTOR VEHICLE ACCIDENT IN ONE DAY

LL Patterson recently assisted a state fund employer in successfully having all its claim costs allocated to the surplus fund where their employee was injured in an auto accident caused by a negligent driver. In July 2017, the BWC implemented a new procedure to help state fund employers in claims where their employees are injured in auto accidents caused by negligent third parties. In these circumstances, if the required documentation is provided, the BWC allocates all the claim costs to the surplus fund and NONE of the claim costs are counted against the employer’s experience. In April 2018, LL Patterson secured all the required documentation and forwarded the request to the BWC. The BWC approved the application on the same day it was received!

Statistical public data from the BWC indicates that currently there are 278 of these applications pending, with 181 approved, and 11 applications pending. So far, the BWC has approved approximately 65% of the applications. LL Patterson is confident we can beat this statistic!

Please note that certain documentation is required. These include Crash Report from law enforcement agency, Citation showing at fault third party, Proof of insurance for at fault third party, Proof that at fault party’s insurance accepts responsibility. The BWC will REJECT any application that does not contain this mandatory information.

If you are a state fund employer and have a claim where one of your employees was injured in an auto accident caused by a negligent third party, PLEASE contact us!! We can help get all the claim costs allocated to the surplus fund so they do not count against your experience. This has the potential of LOWERING your premiums!!!

WARNING – OMBUDS OFFICE NOW ASSISTING PROVIDERS IN BRINGING SI COMPLAINTS!

The BWC SI Department Interim Director, David Sievert, made a surprising announcement on 8-21-18 at a BWC SI Employer Workshop in Cincinnati:

Providers in WC claims will now be directed to the Ombuds Office for assistance in bringing SI Complaints directly against Self Insuring Employers. LL Patterson views this at best as “opening the door” to more SI Complaints, and at worst, injecting Ombuds representatives into the position of advising and assisting providers in adversarial proceedings against SI employers.

The BWC describes the Ombuds Office as a problem solving service for employers, injured workers, and their respective representatives. The Ombuds Office is “independent of the BWC and the Industrial Commission of Ohio, which answers complaints and general inquiries about Ohio’s workers’ compensation system.”

Please contact our office if you have any questions about or need assistance with SI Complaints.